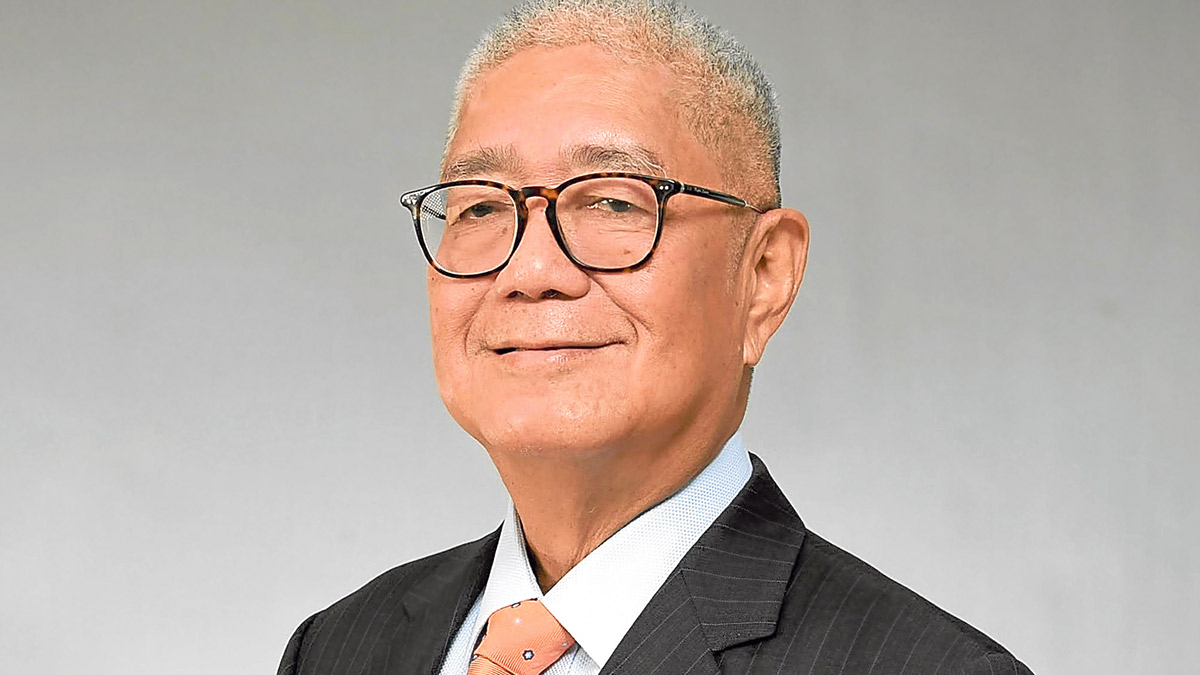

The Bangko Sentral ng Pilipinas (BSP) is not going to wait too lengthy to chop charges to keep away from “pointless” lack of financial output as a consequence of tight monetary situations, Governor Eli Remolona Jr. stated, including that the better-than-expected June inflation gave the central financial institution “extra scope” for doable easing in August.

“The inflation numbers look good. However we’re not there but. The final mile is hard as a result of there’s a threat that we’ll overdo it,” Remolona stated in a discussion board hosted by the Financial Journalists Affiliation of the Philippines (Ejap) on Monday.

“After I stated that we’ve got to be cautious or we’ve got to watch out, that principally means we’ve got to not wait too lengthy for relieving as a result of the longer we wait for relieving the extra doubtless it’s that we’ll trigger a lack of output, which we don’t need,” he added.

READ: Inflation slows to three.7 % in June — PSA

Knowledge launched final week confirmed inflation eased to three.7 % in June from 3.9 % in Might, snapping 4 straight months of ascent primarily as a consequence of decrease prices of electrical energy and transportation.

Whereas the softer value development final month reassured the BSP, Remolona additionally stated there was nonetheless a “50-50” likelihood of inflation overshooting the two to 4 % goal band in July as a consequence of distortions from base results—a state of affairs that, he defined, was already taken under consideration when he gave clearer alerts of easing.

Forward of the Fed?

At its final coverage assembly in late June, the Financial Board (MB) saved the important thing charge unchanged at 6.5 %—the tightest in over 17 years—because it sees fewer upside dangers to its inflation outlook following the choice of the Marcos administration to additional slash the tariff on rice, a significant meals staple.

For that motive, the BSP chief stated it was now “considerably extra doubtless” that the MB would reduce the coverage charge by a complete of fifty foundation factors (bps) this 12 months—with the primary 25-bp reduce presumably in August and forward of the US Federal Reserve, which markets anticipate to ease in September.

“What occurs in our coverage choices is all the time relative as to whether the information is healthier than anticipated. And three.7 [percent June in flation] is healthier than anticipated, so there’s a bit extra scope for relieving, presumably in August,” he stated.

The urgency of the BSP to not wait too lengthy for relieving got here at a time some Fed officers are calling for “persistence” on chopping rates of interest.

READ: US Fed officers careworn ‘persistence’ on charge cuts: minutes

As it’s, there are some market watchers who identified that the BSP can not ease forward of the Fed. It is because the peso could come beneath strain if native yields grow to be much less engaging to overseas investments searching for excessive returns whereas rates of interest are nonetheless excessive elsewhere, particularly within the US which is taken into account a secure haven by traders.

A pointy forex hunch may threat fanning inflation by making imports costlier. It may additionally bloat the peso worth of overseas money owed held by the federal government and Philippine firms.

However Remolona was unfazed, arguing that the pass-through impact of a weak peso on inflation “is just not very giant.” He additionally stated the motion of the US central financial institution is “not a decisive issue” for the BSP by way of financial coverage loosening.

“The US is going through sticky inflation, in order that they’re reluctant to chop. However nonetheless, I feel they might reduce someday this 12 months, and we could reduce someday this 12 months. We simply don’t know who can be first. In order that’s as much as the info,” he stated.

Cheaper rice

In the identical Ejap discussion board, Finance Secretary Ralph Recto stated the federal government expects a median 10 % discount within the retail costs of rice for the remainder of the 12 months as a consequence of tariff cuts. Rice inflation in June slowed all the way down to 22.5 %, from 23 % within the earlier month.

“This might decrease the worth of rice by at the very least P5 per kilo. From a median of P54.40 per kilo final June, costs may go all the way down to beneath P50 as early as August,” Recto stated.

“The decrease rice tariff will assist cut back the general inflation charge for the 12 months to a median of 18 proportion factors, from 3.5 % to three.3 %,” he added.

Regardless of the projected income losses amounting to P9 billion for the 12 months, Recto stated that the federal government’s transfer to decrease the import duties on the staple grain to fifteen %, from 35 % beforehand, is critical to convey down inflation.

“Had we not taken this step, rice costs would have remained above P50, inflicting important ache for customers,” he added. INQ