To account for variations in illness burden throughout a Medicare Benefit (MA) plans affected person inhabitants, makes use of danger adjustment primarily based on affected person illness burden. Particularly, MedPAC notes that:

Medicare makes use of beneficiaries’ traits, resembling age and prior well being circumstances, and a risk-adjustment mannequin—the CMS hierarchical situation classes (CMS– HCCs)—to develop a measure of their anticipated relative danger for coated Medicare spending.

In February 2023, CMS CMS printed a discover of proposed rulemaking to replace their HCC danger adjustment algorithm (v28). These adjustments included (i) leveraging ICD-10 reasonably than ICD-9 codes as the first constructing blocks, (ii) use of 115 HCC indicators reasonably than 79, and (iii) constraining some coefficients to be equivalent throughout severity ranges (e.g., diabetes, coronary heart failure). The brand new algorithm shall be phased in throughout 2024–2026.

One key query is whether or not suppliers beneath conventional Medicare (TM) code in a different way than Medicare Benefit (MA) plans. As a result of MA plan cost from CMS will depend on affected person severity, there’s an incentive to up-code diagnoses. A paper by Carlin et al. (2024) goals to guage whether or not or not this happens. They first clarify the mechanism by means of which MA plans might extra totally seize affected person secondary diagnoses:

MA plans have a chance to assessment medical data to make sure that suppliers didn’t by chance omit a prognosis from encounter data. These opinions are extra essential when the suppliers’ reimbursement doesn’t incent detailed coding of the sufferers’ secondary diagnoses. MA plans to make corrections so as to add or (not often) delete a prognosis by means of CR data. As well as, each MA and TM suppliers might file extra diagnoses by means of a HRA [health risk assessment] throughout a wellness go to or a house go to for this objective.

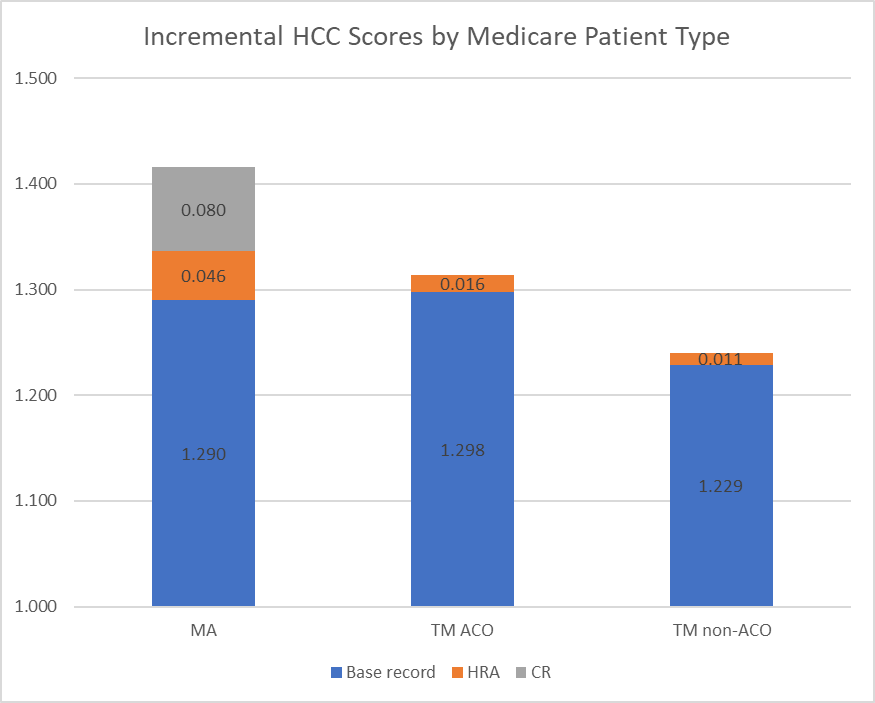

The authors use 2019 CMS claims knowledge and divide the information into 3 cohorts: MA plans, TM beneficiaries attributed to ACOs (“TM ACO”), and TM beneficiaries not attributed to an ACO (“TM non-ACO”). ACO contains sufferers attributable to accountable care organizations (ACO), resembling these collaborating within the Medicare Shared Financial savings Program (MSSP). The authors be aware that the TM non-ACO cohort serves as a key comparability since they don’t seem to be topic to the identical coding depth incentives skilled by MA plans and TM ACOs (since ACO shared financial savings is also danger adjusted).

The authors determine sufferers who had a HRA primarily based on whether or not they had an annual wellness go to, preliminary preventive bodily examination, or chosen residence well being visits (following the Reid et al. 2020 algorithm). The authors additionally use info from encounter claims on whether or not a affected person chart assessment came about. Utilizing these knowledge, the authors propensity-score matched the MA, TM ACO, and TM non-ACO cohorts. The authors then evaluate the matched and unmatched HCC scores and evaluated how the HRA and CR visits impacted the HCC danger scores. They discover:

Incremental well being danger attributable to diagnoses in HRA data elevated throughout protection cohorts consistent with incentives to maximise danger scores:+0.9% for TM non-ACO,+1.2% for TM ACO, and+3.6% for MA. Together with HRA and CR data, the MA danger scores elevated by 9.8% within the matched cohort.

Prognosis codes associated to vascular circumstances, congestive coronary heart failure, and diabetes had the biggest contribution to common HCC rating throughout all 3 cohorts. Vascular, pscyh, and congestive coronary heart failure have been most definitely to extend attributable to HRA/CR coding depth actions.

Whereas different papers have claimed Medicare Benefit have upcoded diagnoses for extra favorable reimbursement, this paper clearly specifies not solely the magnitude of the affect, but in addition the mechanism by means of which it’s most definitely to happen. You’ll be able to learn the total paper right here.